Find The Right Home Loan

With interest rates so low, now is the time to speak to Southstead Finance

Connecting You with The Lifestyle You Desire

At Southstead Finance we know that finding the right home loan is just as important as finding the right property. That’s why we compare hundreds of loans from more than 30 of Australia’s most trusted lenders, finding one that matches your lifestyle and finance needs.

Buy Your First Home

Refinance Your Home Loan

Does your loan scrub up? Refinancing your home loan could save you money. With current interest rates being historically low and home loans more feature-rich than ever Southstead Finance can find the right home loan for you.

Buy An Investment Home

You’re expanding your portfolio and it’s time to make a choice. We’re investors ourselves and can mentor you through your next investment. We’ll help you define your investment goals, discover your borrowing power and find a loan to make your investment plans a reality.

Upsize or Downsize

Growing family or empty nest? Life is constantly changing, no matter your situation, or life stage, we’ll work with you and will provide you with the lowdown on your loan options and work out which one’s right for you.

Build Your Home

We’ll help you build a good foundation by finding the right loan to build your dream home. And applying for the right loan doesn’t need to be complex. We’ll help you understand the different features, rates and fees that apply. You’ll be in your new dream home before you know it.

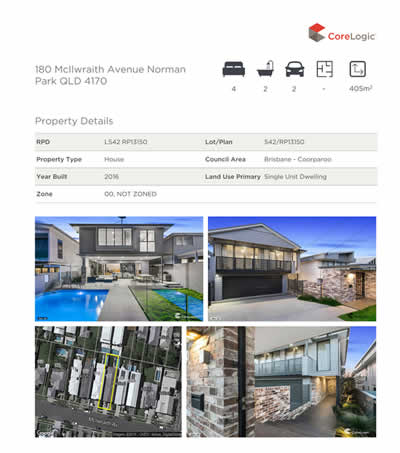

Receive your complimentary property profile report, contact us today.

Like to Know How Much You Can Borrow?

Types of Home Loans and Features

There are hundreds of different home loans available on the market, so many it can be confusing to find the right one. Southstead Finance make it easy and will help you to find a home loan that suits your financial and personal situation.

Fixed Rate Home Loans

During times of very low interest rates, fixing your loan can work to your advantage, because you can retain a low rate for a fixed term even if the rates rise steeply.

You also know exactly how much your repayments will be during your fixed rate term, which can make budgeting easier.

Variable Rate Home Loans

Variable rate home loans are popular and offered by most lenders. With a variable rate loan, the interest rate you are charged can fluctuate in line with market interest rate changes. Because of this, your home loan repayments may also vary.

You can make extra repayments to pay off your home loan sooner. Making additional repayments above your minimum repayment amount can reduce the term of your loan and could save you money on interest.

Interest Only Home Loans

With an interest only home loan, your repayments only pay the interest that is due and does not reduce the balance (or the amount you borrowed). As a result, an interest only loan can only be obtained for a limited period (usually up to five years).

At the end of the interest only period, the loan will automatically convert to a principal and interest loan unless you make an application to extend the interest only period.

First Home Buyers

Family Pledge Guarantee

Saving the deposit for your first home can be difficult and take a number of years. One way to potentially get into your own home sooner is by having a family member act as a guarantor.

Many lenders allow parents or someone who is close to you, to use the equity in their property as security for your home in lieu of you saving the full deposit required. This person is known as a guarantor.

Split

Home Loans

This type of home loan allows you to split your home loan into multiple loan accounts that attract different interest rates.

A common example is to split your home loan to obtain a variable interest rate on one portion of the loan and a fixed rate on the other.

Offset and Redraw

Home Loans

A mortgage offset account is a savings or transaction account that can be linked to your home loan. The balance in this account ‘offsets’ daily against the balance of your home loan before interest is calculated.

An offset account can help you cut years off your home loan term and could save money on interest.

Line of Credit

This can help you turn the equity in your home into money you can actually use.

You’ll be able to access it any time, just like an everyday banking account.

It has no set term or repayment, interest Is variable and tends to be higher than a normal variable or fixed rate term loan. There is typically monthly or annual fees and it is important to consider your spending habits with this type of facility.

Let’s See If We Can Get You a Better Rate

Step One

Book a complimentary appointment

Step Two

We’ll discover more about you and will provide you with a personal assessment

Step Three

We’ll connect you with the right loan for your needs